House prices must drop by an average of 44 percent across the UK, according to research from Open Property Group.

Based on an average annual UK salary of £32,319.60 for a single person, those who dream of owning a home can do so if prices drop to £141,398. Currently, the UK average stands at £251,500.

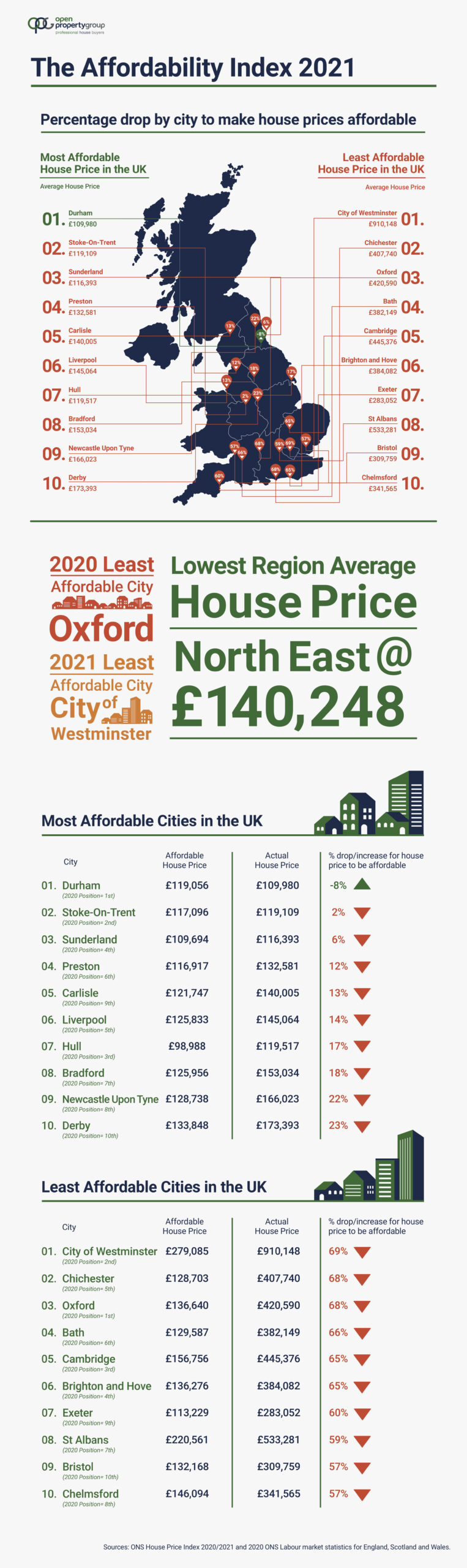

For the fourth consecutive year, the South is the most expensive place to buy a home and the North the most affordable, according to average salaries and house prices within those cities.

Durham tops the most affordable charts again, based on a mortgage of 3.5 times the average salary in that city. In fact, the house price has room to drop by 8 per cent and still be affordable, assuming the buyer has a 20 per cent deposit.

But moving from second place in 2020, to first, is the City of Westminster where house prices must drop by 69 per cent, with both Chichester (up three places to two) and Oxford (down from first to third) dropping by 68 per cent, to make home ownership affordable.

Cities in the South have remained the most overpriced places in the country where prices would need to drop by an average of 64 per cent, in comparison to 13 per cent in the North.

Open Property Group Managing Director, Jason Harris-Cohen, concludes: “We keep seeing houses in the top 10 move positions, but what is clear is that affordability does not meet average salary brackets. Even with the Stamp Duty Holiday and a fall of house prices in England of 7.6 per cent to date, we are still not even close to making home ownership viable for UK residents.

We are now 12 months into a pandemic and in our third lockdown. The socio-economic situation of how businesses and employees operate will play a factor in how house prices are valued in the future. And as we arrive at the Chancellor’s 14 fiscal budget announcement on March 3rd, we will be faced with a more worrying prospect on what this means for residential property ownership.

There needs to be due consideration for the three challenges facing the UK: Brexit, Covid Recovery and moving towards Net Zero by 2030, which will impact the residential market. Furthermore, tax reforms on capital gains and a proposition for a Property Tax that will abolish Council Tax and Stamp Duty in place of an annual levy based on the value of a property, will definitely impact house prices.

Meanwhile, I would like to see government-backed loans for property buyers to encourage lending and create more liquidity in the market. Lenders are going to be risk averse and therefore any reluctance to lend will lead to lower mortgage approvals and ultimately less transactions.”